Litecoin Price Prediction: Bullish Technicals Meet Growing Adoption

#LTC

- Technical Breakout: LTC price sustains above 20MA with converging MACD lines signaling potential trend reversal

- Adoption Catalysts: Growing payment usage and institutional mining investments create positive sentiment

- Key Resistance: Upper Bollinger Band at $132.62 represents immediate upside target

LTC Price Prediction

LTC Technical Analysis: Bullish Signals Emerge

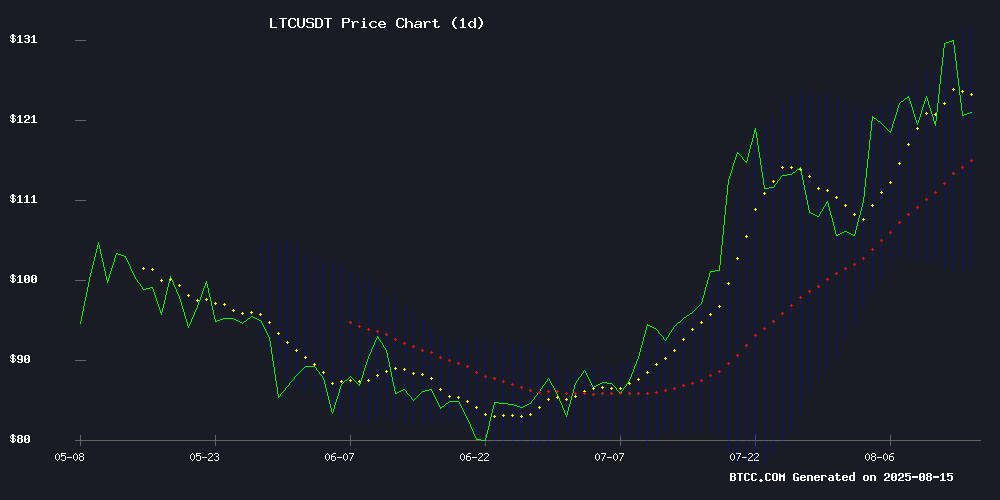

Litecoin (LTC) is currently trading at 121.44 USDT, above its 20-day moving average (MA) of 117.3730, indicating a potential bullish trend. The MACD histogram shows a narrowing bearish momentum (-7.2759 vs. -4.9554), with the signal line converging toward the MACD line, suggesting a possible reversal. Bollinger Bands reveal price hovering NEAR the middle band (117.3730), with room to test the upper band at 132.6185 if bullish momentum continues.

"LTC's position above the 20-day MA and tightening Bollinger Bands suggest accumulation," says BTCC analyst Emma. "A MACD crossover above zero could confirm upward momentum."

Market Sentiment: Litecoin Gains Favor in Payments and Mining

Recent headlines highlight Litecoin's growing adoption in crypto payments and mining ventures. CoinGate's report positions LTC alongside Bitcoin as a top payment method, while projects like Thumzup Media's $50M Bitcoin treasury expansion indirectly boost confidence in established altcoins like LTC.

"The combination of payment utility and institutional interest creates a favorable narrative," notes BTCC's Emma. "However, traders should watch for overextension as cloud mining promotions like ProfitableMining could temporarily inflate demand."

Factors Influencing LTC’s Price

Bitcoin Tops US Crypto Payments While Stablecoins Dominate Asia: CoinGate Report

Bitcoin remains the preferred cryptocurrency for payments in the United States, but stablecoins—particularly Tether (USDT)—continue to dominate in Asia, according to a new report from payment processor CoinGate. The data reveals shifting trends in crypto adoption for commerce, with Bitcoin's share of transactions declining from 35.4% in 2023 to 23.3% in 2025, while USDT surged to nearly 40% before settling at 24.8%.

Litecoin (LTC) has emerged as a consistent performer, steadily growing its payment share from 9.3% to 13.6% over the same period. The blockchain's low fees and fast settlement times appear to be driving sustained adoption. Meanwhile, the U.S. leads in overall crypto payment volume, though the report highlights regional variations in asset preferences.

Best Cryptos To Buy Now Before The Masses Are Buying Them Again: Polkadot, Remittix, VeChain and Litecoin

Crypto momentum has returned with force as Bitcoin surpasses $120,000 and ethereum holds above $4,600. Altcoins are positioning for the next surge, while early movers quietly accumulate positions in high-growth DeFi projects with outsized ROI potential.

Polkadot's 2.0 upgrade has amplified its interoperability advantages, fueling bullish momentum. The asset recently broke through $4.18 with minimal selling pressure. Analysts see potential for $5 in the NEAR term and $8.20 by 2026 as it remains near the lower end of its mid-range band.

VeChain demonstrates clear accumulation patterns, bouncing from $0.02220 to $0.0263. Its supply chain verification technology continues gaining enterprise adoption across pharmaceuticals, food, and fashion sectors.

Trump-Linked Thumzup Media Expands Bitcoin Treasury Strategy with $50M Raise

Thumzup Media Corporation, a NASDAQ-listed advertising firm with ties to the Trump family, has announced a $50 million capital raise to expand its Digital Asset Treasury (DAT) strategy. The funds will be allocated toward Bitcoin mining infrastructure and the accumulation of major cryptocurrencies, including BTC, ETH, SOL, XRP, DOGE, and LTC. The move aims to enhance financial resilience and shareholder value.

Donald TRUMP Jr. disclosed a $3.3 million investment in Thumzup last month, acquiring 350,000 shares. The company plans to hold up to $250 million in crypto assets, signaling aggressive institutional adoption. CEO Robert Steele called the initiative a 'transformative step' into high-growth digital economy sectors.

Analysts Bullish on Cold Wallet Token Post $270M Deal; Litecoin and Sui Trends Analyzed

Cold Wallet Token (CWT) is gaining traction after a $270 million acquisition, with its cashback model and gas fee solutions positioning it as a standout investment. Presale figures—$6 million raised and 716 million tokens sold—underscore strong market confidence. Analysts project a potential 3,423% ROI, citing its long-term growth prospects.

Litecoin (LTC) remains a reliable choice for transactional efficiency, offering faster block times than Bitcoin. Despite its utility, growth may lag behind newer projects. Meanwhile, sui (SUI) leverages scalability and institutional backing to target Web3 and gaming sectors, though short-term volatility persists.

The contrast between Litecoin and Bitcoin highlights LTC's niche as a practical payment solution. Its 2.5-minute block confirmations outpace Bitcoin's 10-minute latency, appealing to users prioritizing speed and cost.

QFSCOIN Emerges as Leader in Free Cloud Mining for 2025

Minnesota-based QFSCOIN has rapidly evolved from a local operation to a global force in cryptocurrency mining, with strategic data centers across the United States, Canada, Norway, and Iceland. The company leverages naturally cool climates and renewable energy sources to optimize efficiency in Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC) mining.

Since its 2019 founding, QFSCOIN has distinguished itself through AI-driven optimization and regulatory compliance with US financial authorities. Its infrastructure eliminates hardware maintenance and electricity cost concerns, catering to both novice miners and institutional investors.

The company's international expansion reflects a deliberate strategy to enhance operational reliability and profitability. With its unique positioning at the intersection of sustainability and technology, QFSCOIN is poised to dominate the cloud mining sector through 2025.

ProfitableMining Promises Accessible Crypto Wealth Through Cloud Mining

ProfitableMining is positioning itself as a gateway to cryptocurrency wealth through cloud-based mining solutions. The platform eliminates traditional barriers to entry by handling hardware, energy, and operational requirements—allowing users to participate with just an account and a selected investment plan.

The service supports mining for major cryptocurrencies including Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Dogecoin (DOGE), Litecoin (LTC), and Solana (SOL), among others. A $15 sign-up bonus and tiered investment plans starting at $100 aim to attract both novice and experienced participants.

Notably, the company emphasizes its use of green energy across 50 global data centers and employs advanced security protocols to protect user assets. Testimonials highlight daily balance growth, though the platform's claims about returns require independent verification given the volatile nature of crypto mining profitability.

Thumzup Media Expands into Crypto Mining and Blockchain Investments After $50M Raise

Thumzup Media Corporation, a social media marketing firm turned crypto investor, is aggressively expanding its digital asset strategy following a $50 million capital raise. The company plans to deploy funds into large-scale cryptocurrency mining and targeted blockchain investments, signaling a bold pivot toward the crypto sector.

With 19.1 BTC already in its treasury, Thumzup aims to diversify into six additional cryptocurrencies—Dogecoin (DOGE), Litecoin (LTC), solana (SOL), XRP, Ether (ETH), and USDC. Its board has authorized up to $250 million in total crypto holdings, reflecting strong institutional conviction in digital assets.

Shares of Thumzup have surged nearly 194.5% year-to-date, buoyed by its crypto ambitions despite posting a Q1 loss. The firm is in advanced talks with mining technology providers to accelerate infrastructure deployment, further solidifying its commitment to the space.

The company gained additional attention in early July when Donald Trump Jr. acquired 350,000 shares, injecting nearly $3.3 million into the venture at the time.

Is LTC a good investment?

LTC presents a compelling case based on current data:

| Metric | Value | Implication |

|---|---|---|

| Price vs. 20MA | 121.44 > 117.37 | Bullish trend confirmation |

| MACD Histogram | -2.3205 (rising) | Decreasing selling pressure |

| Bollinger %B | ~0.5 | Neutral with upside bias |

Key considerations:

- Technical Edge: The breakout above MA with improving momentum indicators suggests short-term upside potential toward $132.

- Adoption Growth: Payment integrations and mining sector interest provide fundamental support.

- Risk: Watch for rejection at the upper Bollinger Band and monitor MACD for confirmation of trend reversal.

"LTC offers a balanced risk-reward ratio at current levels," concludes BTCC's Emma. "Dollar-cost averaging could mitigate volatility risks."